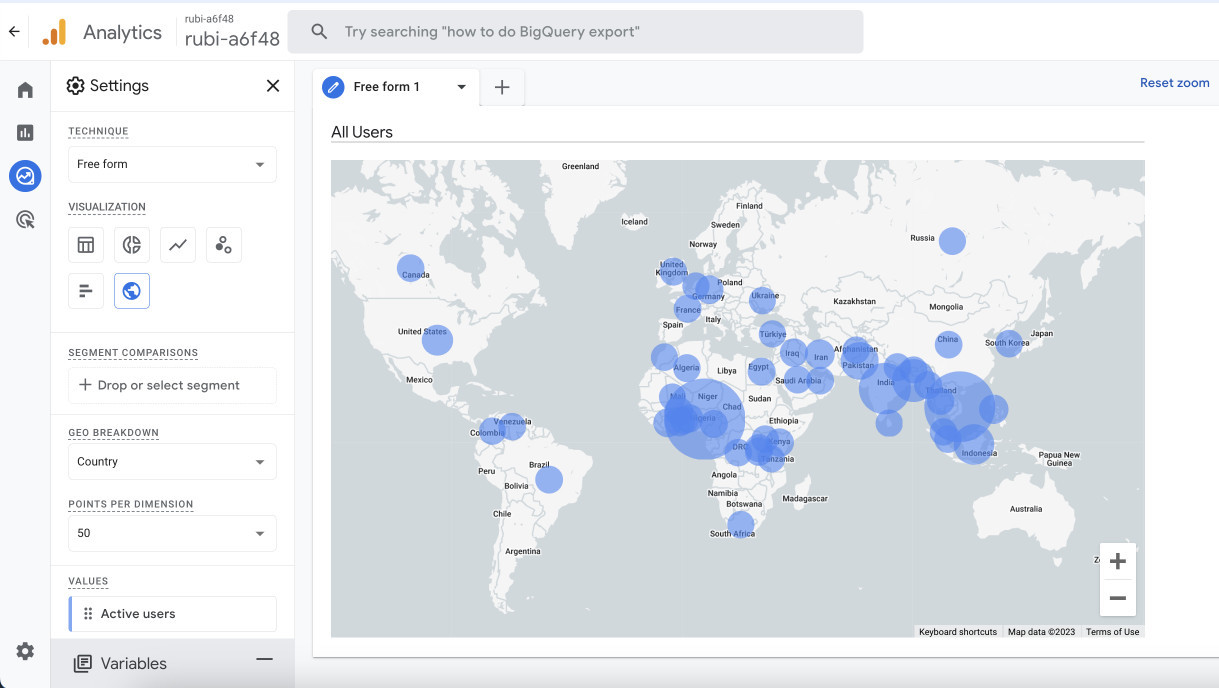

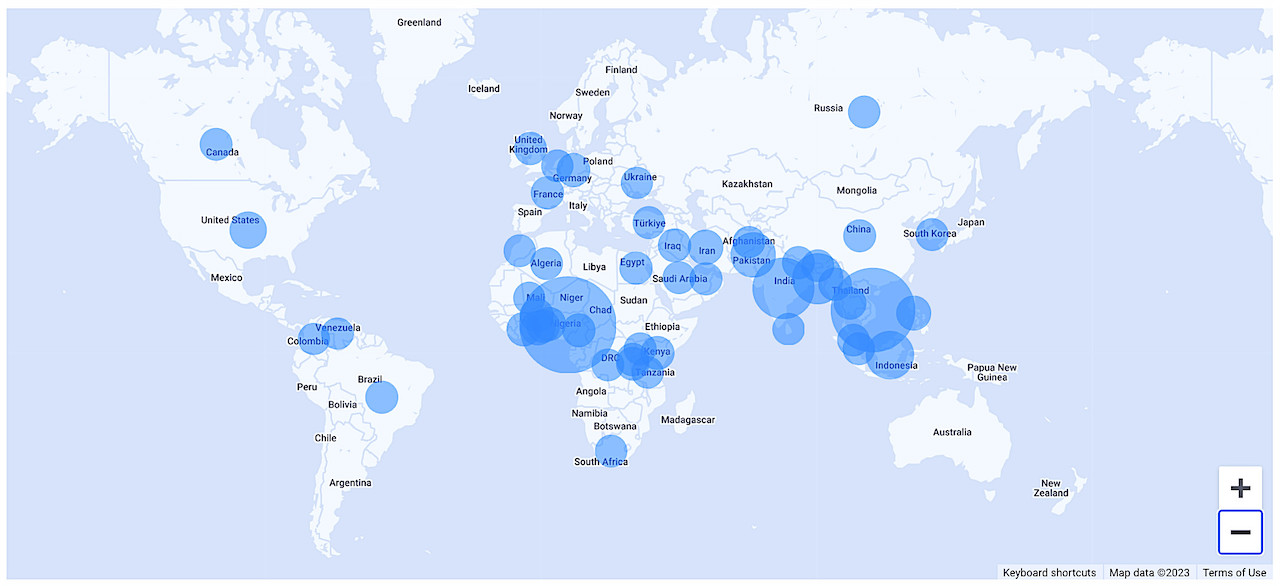

Deployed V.Mine Mining Area to 190 countries and territories

Hello Rubimily mining community! We are moving strongly into a new phase of the concept of assets in the digital space. For the first time, under RUBI's digital asset theory, a new definition of human interaction is identified with the concept of digital resources and as a commodity born under human agency, can ownership and transfer of ownership on blockchain technology.

All 190 territories are ready to select their own mines on October 24, 2023.

Different from the tens of thousands of cryptocurrency projects that have appeared over the past decades without any application in the economy, the Rubi Network project chooses to apply blockchain to define behavior in digital space as a a type of asset that can be owned by the creator of the act, and Rubi Network was first pioneered in digital goods theory.

Mining RUBI resources by country!

Up to now, the RUBI mining community is present in more than 190 countries and territories. To create a premise and management basis for the ownership and management of mined resources by country, we announce that we have completed the establishment of mining zoning for all countries and territories. a visual mine (Visual Mine) in mining option.

Top 50 regions with the largest number of miners

By establishing country-specific mining mines, we lay the foundation for our ability to comply with all resource tax laws and policies in each country specifically.

Ready to Apply Natural Resources Tax Policy According to Regulations

Countries with resource tax policies for digital assets are being discussed and may be applied in the future. The creation of country-based mining zones ensures that Rubi Network's digital resource mining fully meets each country's requirements and standards, while also contributing to revenue collection. national policy and sustainable development for mining communities.

The tax collection rate is still 0%:

Don't worry about tax rates, until now most countries do not have specific regulations related to setting tax rates for resources in the digital space. Therefore, the tax rate applied at each country's mines remains at 0% until there is an official legal document to specifically regulate the tax rate for digital resources issued by that country.

Thus, the tax rate only applies when your country passes a digital resources tax law and has an official governing document.

Conclusion and Thanks!

We would like to express our sincere thanks to the miners and everyone involved in mining and owning a digital asset position for yourself and your country through Rubi Network. We understand that digital resources are becoming increasingly important in their competition for value relative to other types of physical resource assets, and our community is making an important contribution to the concept of resources and digital assets in general.

We also thank our valued miner partners, as we are witnessing a significant step forward in developing the Rubi Network and mining digital resources in the best way for everyone. Together, we will continue to shape the future of digital resources and create new opportunities for prosperity.

Andy Nguyen

Comments (18)

Mada201236

تحيه لكل مجتمع روبي من مصر

0 Trả lời Chia sẻ 05:48 21/01/2024

0 trả lời

Amos12

Hello ????

1 Trả lời Chia sẻ 14:04 23/11/2023

0 trả lời

Kirkuk4salah

KIRKUK4SALAH

2 Trả lời Chia sẻ 04:45 15/11/2023

0 trả lời

Kirkuk4salah

https://rubi.click/mana-f-airdrop-roadmap-overview/200.html

1 Trả lời Chia sẻ 04:44 15/11/2023

0 trả lời

fety2468

Hello,where is Rubi KYC (Madagascar)

0 Trả lời Chia sẻ 14:23 13/11/2023

0 trả lời